Marketing and Empathy Psychology

Form 941: What’s Next For 2025?

By - Vicki M. Lambert, CPP

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- March 4, 2025 | 1:00 pm (EST) |

- 90 Mins

Preview:

This webinar covers the IRS Form 941 and its accompanying Form Schedule B for 2025. It discusses what is new for this version as well as the requirements for completing each form line by line. It includes the filing requirements and tips on reconciling and balancing the two forms. The webinar also covers the forms used to amend or correct the returns.

Background:

Form 941 is the link between your payroll records and the IRS tax records. Proper administration of this vital form is critical if you want to avoid IRS Notices and the penalties and interest that accompany them. Schedule B is also a crucial form for many employers. The IRS demands that the Form 941 and the Schedule B match to the penny…every single time…without fail!

It has always been a requirement that Forms 941 be reconciled with Forms W-2 prior to submitting each form. If the employer fails in this reconciliation, the IRS and Social Security Administration can both assess penalties! This reconciliation has become even more critical these past few years.

Learning Objectives:

- For the attendee to understand the requirements for completing the latest version of the Form 941 correctly line by line.

- To ensure that the attendee has the basic knowledge to complete Form Schedule B according to the IRS regulations and to ensure that it reconciles down to the penny with the Form 941 prior to submission.

- To ensure the attendee knows when a Form 941-X is required and provide the attendee with the basic knowledge of how to complete Form 941-X.

- To demonstrate to the attendee the reconciliations needed under IRS and Social Security Administration regulations.

This Presentation will cover:

- Line by line review of the 2025 Form 941

- Tips for completing the Schedule B—liability dates vs. deposit dates

- Tips to balance Form 941 and Schedule B to the penny—as required by the IRS

- Form due dates

- Who should sign the Form 941

- Reporting third party sick pay, group term life insurance and tips correctly

- How to reconcile the Forms 941 with the Forms W-2

- What to do if you discover an error in deposits for the quarter when completing the Form 941

- Using the 941X form to correct the Form 941

Who will Benefit:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Vulputate eros arcu magnis donec sem pretium scelerisque a etiam. Eros aliquam elit si mattis phasellus at orci letius ligula posuere. Sodales maecenas facilisis diam egestas dictumst si fames mus fermentum conubia curabitur. Ornare nisi consectetur semper justo faucibus eget erat velit rhoncus morbi.

Speaker Detail

Vicki M. Lambert, CPP

Vicki M. Lambert, CPP, is President and Academic Director of The Payroll Advisor™, a firm specializing in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news service, Payroll 24/7, which keeps payroll professionals up-to-date on the latest rules and regulations. With over 40 years of hands-on experience in all facets of payroll functions as well as over 30 years as an educator, training program developer, and author, Ms. Lambert has become the most sought-after and respected voice in the practice and management of payroll issues. She has conducted open market training seminars on payroll issues across the United States that have been attended by executives and professionals from some of the most prestigious firms in business today. A pioneer in electronic and online education, Ms. Lambert produces and presents payroll related audio seminars, webinars and webcasts for clients, APA chapters and business groups throughout the country. Ms. Lambert is an adjunct faculty member at Brandman University in Southern California and is the instructor for the American Payroll Association’s “PayTrain” online program also offered by Brandman University.

Webinar Information

- Duration : 90 Mins

- Date / Time(EST) : March 4, 2025 | 1:00 pm

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- Jakarta, Indonesia

Share this event

Related products

-

2024 Independant Contractor New DOL Rule

$249.00 – $399.00 Select options -

Employee Retention 2024: This is not your 2010s workplace

$199.00 – $399.00 Select options -

People are Stressed and Angry; Keep Your Cool, Your Customers & Others

$199.00 – $349.00 Select options -

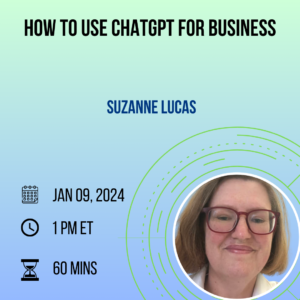

How to Use ChatGPT for Business

$199.00 – $349.00 Select options