Marketing and Empathy Psychology

Preparing for Year End 2024 and Year Beginning 2025

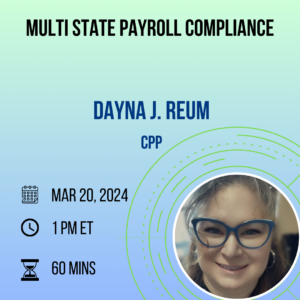

By - Dayna J. Reum, CPP

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- December 9, 2024 | 1:00 pm (EST) |

- 60 Mins

The IRS provides updated tax rates and changes how taxable income is calculated each year. This webinar will assist the seasoned and new payroll professional on new legislation that need to be considered. This webinar will also assist around W-2 processing to include W-2 to understand all the boxes on the form W-2 and what should be reported. A brief overview of year end and W-2 best practices will also be discussed.

Review of new W-2 reporting deadlines and penalties and updates to how we process the W-2 form. Review of the new Form W-4

Topics covered in the webinar

- Details of how to close the 2024 year to make sure your W-2’s are correct, and 941 reconciliation happens correctly.

- Review box by box of the W-2

- Most up to date legislation releases

- Calculating tax in 2025

- State specific W-2 reporting and what you need to know

- W-2 Requirements

- W-2 box by Box review

- Updated legislation to consider for W-2 and 2024

- State by State discussion of special W-2 considerations

- Year End and W-2 best Practices

- New year legislation

Vulputate eros arcu magnis donec sem pretium scelerisque a etiam. Eros aliquam elit si mattis phasellus at orci letius ligula posuere. Sodales maecenas facilisis diam egestas dictumst si fames mus fermentum conubia curabitur. Ornare nisi consectetur semper justo faucibus eget erat velit rhoncus morbi.

Speaker Detail

Dayna J. Reum, CPP

Dayna is currently the Senior Director of Payroll & HRIS at Ann and Robert H. Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field over 20 years. Starting as a payroll clerk at a small Tucson company. Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards to include Customer Service and Acquisitions and Divestitures. Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. Dayna has also assisted in the CPP preparation classes for the Chicago APA Chapter. She has served on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

Webinar Information

- Duration : 60 Mins

- Date / Time(EST) : December 9, 2024 | 1:00 pm

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- Jakarta, Indonesia

Share this event